Manufacturing businesses calculate their overall expenses in terms of the cost of production per item. That number is, of course, critical to setting the wholesale price of the item. Direct labor would include the workers who use the wood, hardware, glue, lacquer, and other materials to build tables. In fact, you already know that labor costs can spiral out of control if you don’t meticulously monitor them. Manufacturers can compare the costs of making a product using different manufacturing processes. This helps them understand the most efficient process and the investment they need to make for the selected process.

1. Direct materials as a type of manufacturing costs

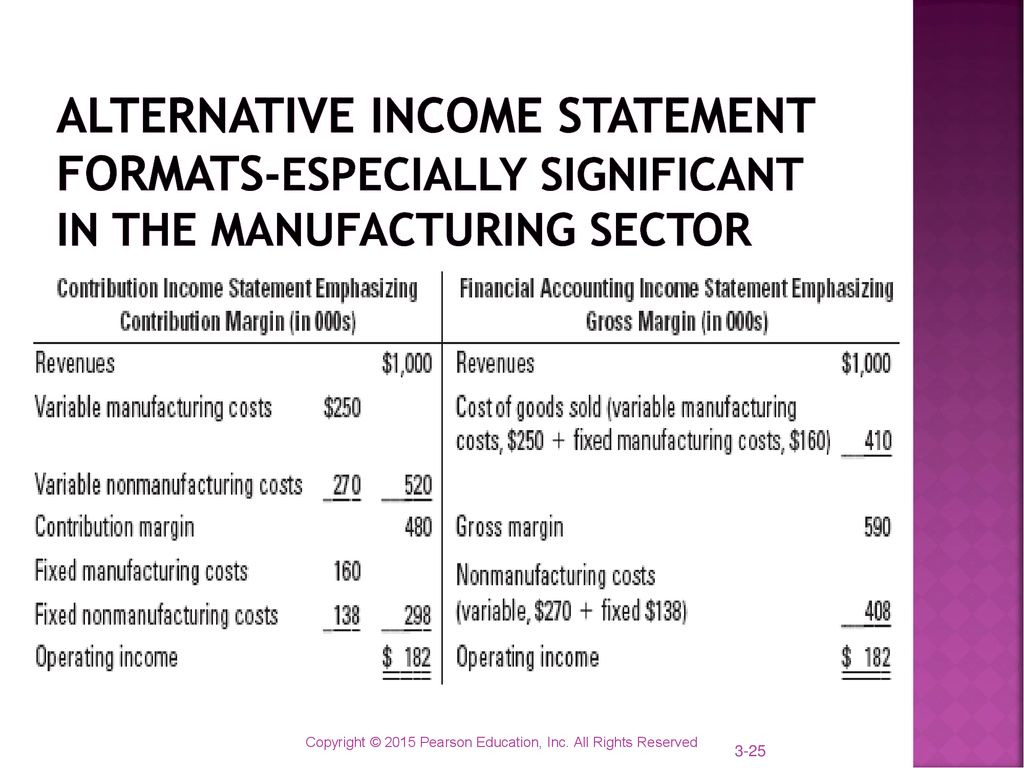

Therefore, the per-item cost of manufacturing falls and the business becomes more profitable. Both of these figures are used to evaluate the total expenses of operating a manufacturing business. The revenue that a company generates must exceed the total expense before it achieves profitability. Note “Business in Action 2.3.1” details the materials, labor, and manufacturing overhead at a company that has been producing boats since 1968.

Example #4: Indirect manufacturing costs (factory overheads)

Examples of general and administrative costs include salaries and bonuses of top executives and the costs of administrative departments, including personnel, accounting, legal, and information technology. The two broad categories of costs are manufacturing costs and turbotax mobile app, do your taxes on your phone, tablet, or computer nonmanufacturing costs. As the manufacturing process involves raw materials and finished goods, all of these are considered assets. The materials that are yet to be assembled /processed and sold are considered work-in-process or work-in-progress (WIP) inventory.

Production Costs vs. Manufacturing Costs: What’s the Difference?

These costs are not directly tied to the production of goods or services, but rather to the overall operation of the company. Examples of period costs may include rent, salaries and wages of administrative staff, office supplies, marketing and advertising expenses, and other similar expenses. While these costs are necessary for the overall functioning of the business, they do not directly contribute to the production of goods or services. Manufacturing costs refer to those that are spent to transform materials into finished goods. Manufacturing costs include direct materials, direct labor, and factory overhead. Firms account for some labor costs (for example, wages of materials handlers, custodial workers, and supervisors) as indirect labor because the expense of tracing these costs to products would be too great.

To produce each widget, the business must purchase supplies at $10 each. After subtracting the manufacturing cost of $10, each widget makes $90 for the business. Costs of production include many of the fixed and variable costs of operating a business. Note “Business in Action 2.3.2” provides examples of nonmanufacturing costs at PepsiCo, Inc. Note 1.48 “Business in Action 1.6” provides examples of nonmanufacturing costs at PepsiCo, Inc.

That’s why you need a reliable partner to buddy up with and slash your costs. In case you’re spending too many resources on a task or project, the option to set budgets in Clockify will give you a detailed insight into how you can better balance those resources. If the net realizable value of the inventory is less than the actual cost of the inventory, it is often necessary to reduce the inventory amount. A word used by accountants to communicate that an expense has occurred and needs to be recognized on the income statement even though no payment was made. The second part of the necessary entry will be a credit to a liability account.

These costs are represented during a period of time and are not calculated into the cost of good sold. Nonmanufacturing costs consist of selling expenses, including marketing and commission expenses and sales salaries and administration expenses, such as office salaries, depreciation and supplies. The purpose of addressing these costs differently as part of a total manufacturing cost formula is based on the fact that they are accounted for differently when structuring the income statement and balance sheet. Manufacturing overhead are costs that are not part of labor or material cost and can be either a fixed or variable cost. For instance, fixed overhead costs consist of property taxes, insurance premiums, depreciation and nonmanufacturing employee salaries, according to Accounting Tools. Whereas, variable direct manufacturing overhead costs include indirect labor, indirect material and utilities.

- The sales price of each table varies significantly, from $1,000 to more than $30,000.

- For a manufacturer these are expenses outside of the manufacturing function.

- After manufacturing product X, let’s say the company’s ending inventory (inventory left over) is $500.

- Tracking the number of hours each employee works on the production line can be tricky.

For example, a clothing manufacturer considers employees that dye the cloth, cut the cloth and sew the cloth into a garment as direct labor costs. However, designers and sales personnel are considered nonmanufacturing labor costs. All these costs – marketing and sales expenses, G&A, and R&D – are non-manufacturing overhead costs. These costs aren’t directly related to the physical production of their devices but are essential to running the business and its long-term growth.

These indirect costs, also called factory or manufacturing overheads, include costs related to property tax, insurance, maintenance, and other indirect operations that support the production process. Indirect manufacturing costs include all other expenses incurred in manufacturing a product except direct expenses. Recall from other tutorials that variable costs change in proportion to production. For instance, in our example of Friends Company, the company purchases metal parts (raw material) to produce valves. The more valves are produced, the more parts Friends Company has to acquire. Therefore, parts have a variable nature; the amount of raw materials bought and used changes in direct proportion to the amount of valves created.