Investors can use the debt-to-equity ratio to help determine potential risk before they buy a stock. As an individual investor you may choose to take an active or passive approach to investing and building a nest egg. The approach investors choose may depend on their goals and personal preferences. In some cases, companies can manipulate assets and top 4 tiers of conflict of interest faced by board directors liabilities to produce debt-to-equity ratios that are more favorable. If they’re low, it can make sense for companies to borrow more, which can inflate the debt-to-equity ratio, but may not actually be an indicator of bad tidings. For example, if a company takes on a lot of debt and then grows very quickly, its earnings could rise quickly as well.

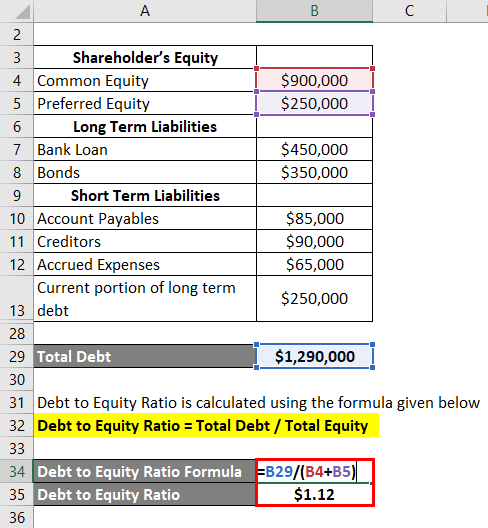

Calculating a Company’s D/E Ratio

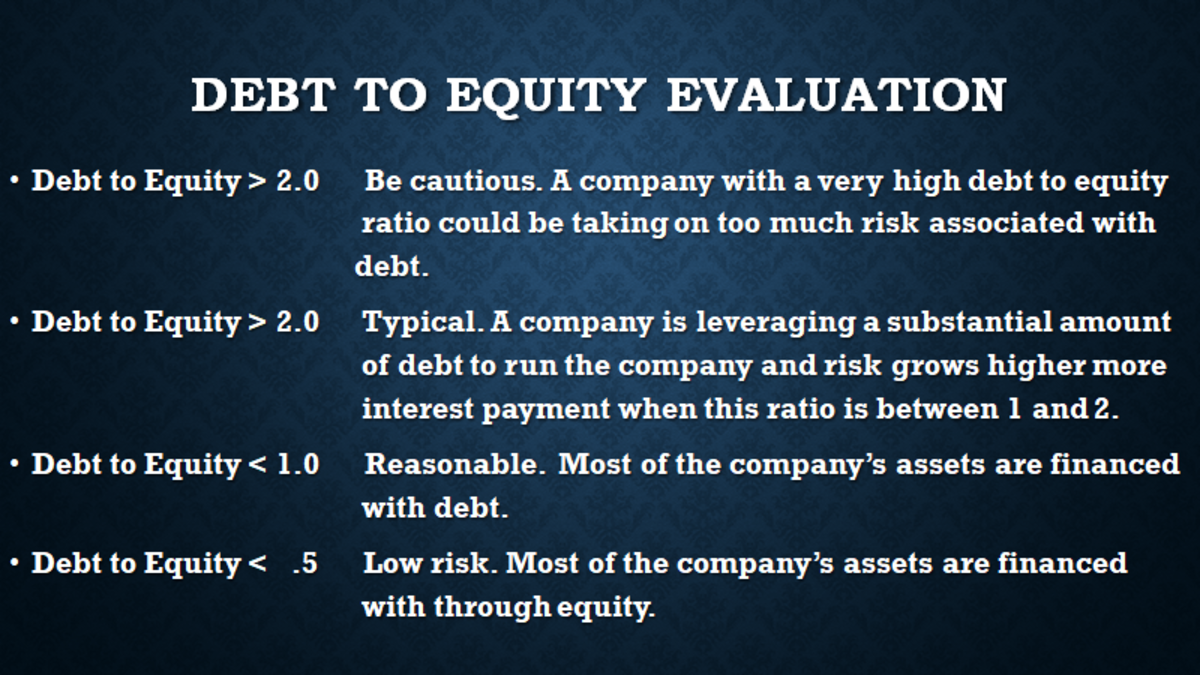

A high ratio indicates that a company may be at risk of default on its loans if interest rates suddenly rise. A ratio below 1 means that a greater portion of a company’s assets is funded by equity. A company with a negative net worth can have a negative debt-to-equity ratio. A negative D/E ratio means that the total value of the company’s assets is less than the total amount of debt and other liabilities.

What is the debt-to-equity ratio?

It is widely considered one of the most important corporate valuation metrics because it highlights a company’s dependence on borrowed funds and its ability to meet those financial obligations. The Debt to Equity Ratio (D/E) measures a company’s financial risk by comparing its total outstanding debt obligations to the value of its shareholders’ equity account. In a basic sense, Total Debt / Equity is a measure of all of a company’s future obligations on the balance sheet relative to equity. However, the ratio can be more discerning as to what is actually a borrowing, as opposed to other types of obligations that might exist on the balance sheet under the liabilities section.

Do you already work with a financial advisor?

The debt-to-equity ratio measures how much debt and equity a company uses to finance its operations. The debt-to-asset ratio measures how much of a company’s assets are financed by debt. With debt-to-equity ratios and debt-to-assets ratios, lower is generally favored, but the ideal can vary by industry. In some cases, investors may prefer a higher D/E ratio when leverage is used to finance its growth, as a company can generate more earnings than it would have without debt financing.

- Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications.

- The remaining long-term debt is used in the numerator of the long-term-debt-to-equity ratio.

- There are various companies that rely on debt financing to grow their business.

- Tesla had total liabilities of $30,548,000 and total shareholders’ equity of $30,189,000.

- It is the opposite of equity financing, which is another way to raise money and involves issuing stock in a public offering.

A debt-to-equity ratio that seems too high, especially compared to a company’s peers, might signal to potential lenders that the company isn’t in a good position to repay the debt. The debt-to-equity ratio can clue investors in on how stock prices may move. As a measure of leverage, debt-to-equity can show how aggressively a company is using debt to fund its growth. It is possible that the debt-to-equity ratio may be considered too low, as well, which is an indicator that a company is relying too heavily on its own equity to fund operations.

Determining whether a company’s ratio is good or bad means considering other factors in conjunction with the ratio. Of note, there is no “ideal” D/E ratio, though investors generally like it to be below about 2. On the other hand, a comparatively low D/E ratio may indicate that the company is not taking full advantage of the growth that can be accessed via debt. Simply put, the higher the D/E ratio, the more a company relies on debt to sustain itself. Liabilities are items or money the company owes, such as mortgages, loans, etc. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice.

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master’s in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses.

A higher D/E ratio means that the company has been aggressive in its growth and is using more debt financing than equity financing. Over time, the cost of debt financing is usually lower than the cost of equity financing. This is because when a company takes out a loan, it only has to pay back the principal plus interest. It is the opposite of equity financing, which is another way to raise money and involves issuing stock in a public offering.

However, an ideal D/E ratio varies depending on the nature of the business and its industry because there are some industries that are more capital-intensive than others. Utilities and financial services typically have the highest D/E ratios, while service industries have the lowest. Different industries vary in D/E ratios because some industries may have intensive capital compared to others. The principal payment and interest expense are also fixed and known, supposing that the loan is paid back at a consistent rate. It enables accurate forecasting, which allows easier budgeting and financial planning.